As Canada’s deposit insurer and as the resolution authority for federally-regulated deposit-taking institutions, CDIC’s ability to deliver on its mandate rests on a sound understanding of key trends and developments in member institutions’ activities and business environment. One critical aspect is the manner with which member institutions fund their lending activities. CDIC closely monitors and analyzes available data and information on our members’ financial profiles and funding activities to gain a deeper understanding of CDIC’s insurance obligations and potential risk exposures.

As of April 2020, CDIC’s members reported total deposits of $4.6 trillion, of which $3.8 trillion is held in Canada with the rest held in foreign subsidiaries owned by our member institutions. Currently $968 Bn in deposits are covered by CDIC.

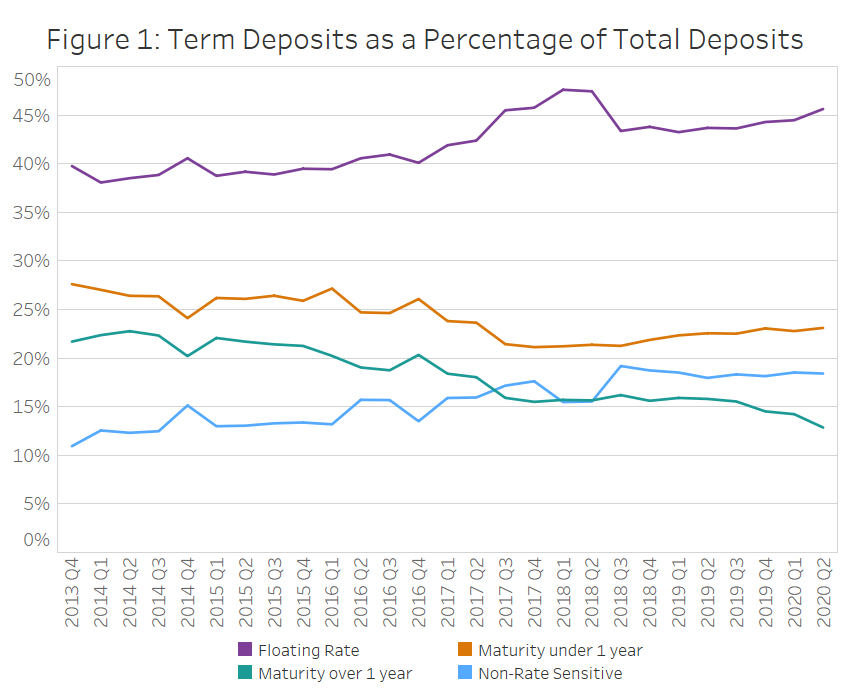

Shift towards shorter term and floating rate deposits

Over the last year, there has been a slight shift from longer term, fixed rate deposits (deposits with maturities greater than 1-year) towards demand of short term, floating rate deposits (e.g., high interest savings accounts). The shift can be attributed to the relatively higher interest rates being offered on floating rate and demand deposits relative to longer-dated and fixed rate deposits.

Membership deposits and insured deposit growth accelerated through 2020

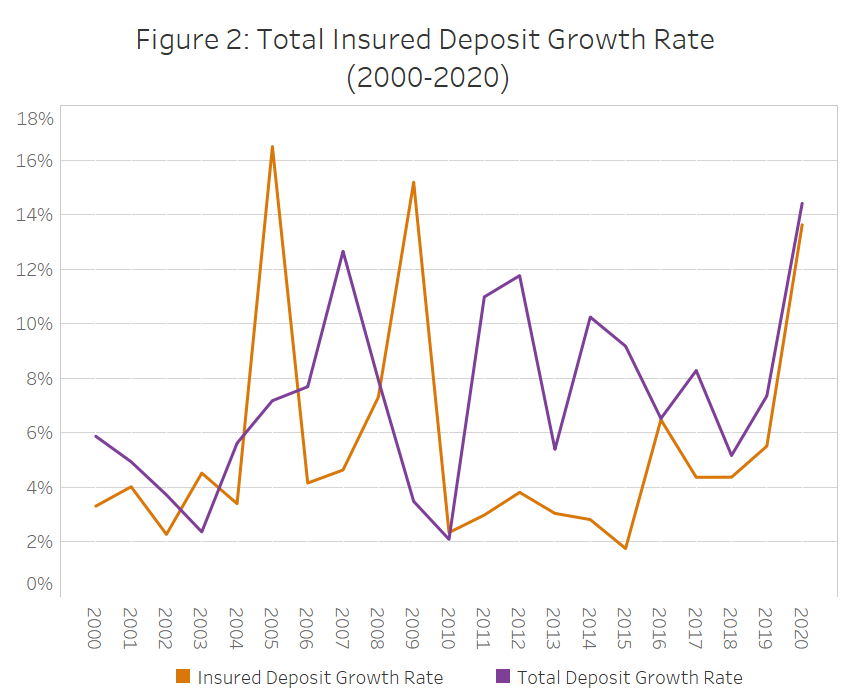

Both insured deposits and total deposits grew significantly over the previous year. The growth rate of total deposits doubled from 2019, growing by 14.4% year-over-year, while insured deposits grew 13.6% year-over-year (see Figure 2).

The growth in total deposits reflects several potential factors stemming in particular from the rising uncertainty surrounding the effects of the COVID-19 pandemic, including fiscal stimulus measures and economic conditions.

Meanwhile, amendments to the deposit insurance eligibility criteria and economic impacts of COVID-19 drove the recent growth in insured deposits. In June 2018, the Government of Canada amended the CDIC Act to modernize and enhance Canada’s deposit insurance framework. Several changes impacting deposit insurance coverage came into force on April 30, 2020, which extended coverage to include eligible deposits held in foreign currency and eligible deposits with terms greater than 5 years and eliminated coverage for travelers cheques (travelers cheques are no longer issued by CDIC member institutions).

Foreign currency deposits have grown rapidly and increased 20.1% year-over-year. Over the past 5 years, foreign currency deposits at CDIC member institutions have grown 71.9% or by a compound annual growth rate (“CAGR”) of 11.4%, compared with total deposits, which grew 58% over the last 5 years and had a CAGR of 9.6% (see Table 1). These divergent growth rates are in part attributable to many of Canada’s larger banks expanding deposit gathering activities in foreign jurisdictions, and to foreign exchange movements (which inflate foreign deposit figures when the Canadian dollar depreciates).

Table 1: Long Term Deposit Trends: Canadian and Foreign Currency and Current Value (as at 2020Q2)

| 5Yr Total Growth | 5Yr CAGR | 10Yr Total Growth | 10Yr CAGR | Q2/20 Value ($M) | |

|---|---|---|---|---|---|

| Personal Canadian Currency | 38.8% | 6.8% | 82.1% | 6.2% | 1,178,607 |

| Personal Foreign Currency* | 87.8% | 13.4% | 242.5% | 13.1% | 639,461 |

| Non Personal Canadian Currency | 54.2% | 9.1% | 116.9% | 8.1% | 1,078,043 |

| Non Personal Foreign Currency* | 66.6% | 10.7% | 228.9% | 12.6% | 1,724,139 |

| Total Deposits | 58.0% | 9.6% | 149.0% | 9.6% | 4,620,251 |

| Total Foreign Currency Deposits* | 71.9% | 11.4% | 232.5% | 12.8% | 2,363,601 |

| *Foreign Currency reported in CAD Equivalent | |||||

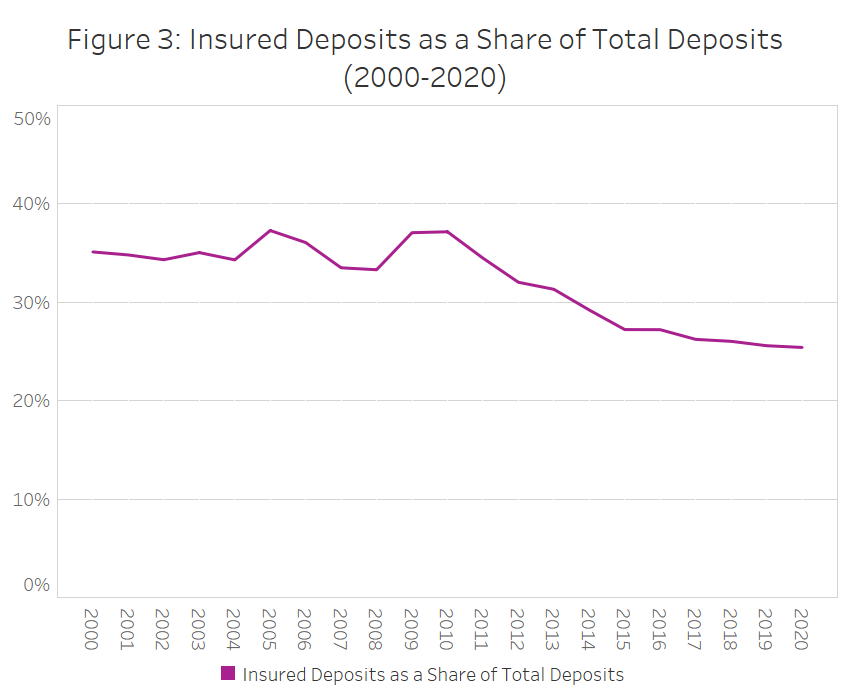

Despite the uptick in insured deposits, insured deposit growth has lagged total deposit growth over the last decade, resulting in a decline in the ratio of CDIC-insured deposits to total deposits. Total deposits grew more relative to insured deposits due to comparatively high growth in deposits over the $100k CDIC insurance limit and growth in foreign deposits in the international operations of certain CDIC members. Eligible insured deposits currently represent about 25% of total deposits, compared to 35% in 2000 (see Figure 3). While declining over the last decade, the share of insured deposits appears to have stabilized. This trend is heavily influenced by Canada’s largest banks, which account for 21.8% of total insured deposits as a percentage of total deposits.

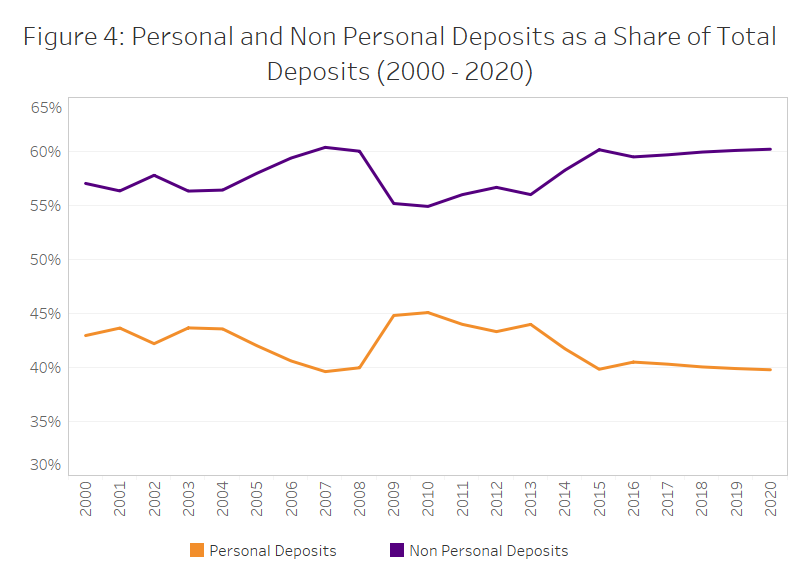

Canadians continue to benefit from a high level of deposit protection

The declining proportion of eligible insured deposits at some institutions has not translated into less deposit protection for Canadian households. Nearly all personal deposit accounts are fully protected by CDIC, meaning that ordinary Canadians continue to benefit from a high level of protection for their deposit savings. For 98% of Canadians, CDIC’s deposit insurance covers all of their deposits. Following a brief rise during the financial crisis of 2008, the share of personal deposits (e.g., interest-bearing demand and notice deposits from individuals) in total deposits has remained relatively stable at approximately 40%.

Uncertainty and change on the horizon

Uncertainty and change remain on the horizon in virtually all aspects of banking as individual Canadians, financial institutions, and regulators respond to the challenges posed by the COVID-19 pandemic.

While several changes related to the Government of Canada’s amendment to the CDIC Act came into force on April 30, 2020, the remaining changes are slated to come into force on April 30, 2022. These changes are designed to modernize and enhance the Canadian deposit insurance framework and extend insurance coverage to support CDIC in the delivery of its mandate, to anticipate and adapt to the changing banking landscape and to meet the needs of depositors.

As Canada adapts to the challenges posed by the COVID-19 pandemic, CDIC remains committed to protecting the deposits of Canadian households and businesses, and to promoting their trust in the Canadian financial system and the confidence that their hard-earned savings placed with our member institutions remain safe and secure.