Crisis preparation in the time of COVID: protecting deposits and the financial system

February 5, 2021

Speaking Notes by Peter Routledge, President and CEO – C.D. Howe Institute – January 27, 2021.

Greater Vancouver Board of Trade’s Economic Outlook Forum – Speaking Notes

February 2, 2021

Speaking Notes by Peter Routledge, CDIC’s President and CEO, at the Greater Vancouver Board of Trade’s Economic Outlook Forum on January 21, 2021.

Deadlines

- By February 28, 2021 or April 30, 2021

Within 120 days of the member’s fiscal year-end, members must submit audited and Board-approved end-of-year financial statements, with comparisons to the preceding year’s statements, to CDIC, according to section 15(1) of the CDIC Deposit Insurance Policy By-law. At that time, members must also supply CDIC with a current list of all their subsidiaries and affiliates and a current list of all their directors and officers, along with titles, addresses, email addresses and phone numbers. Submissions are to be provided by email to members@cdic.ca. - By April 30, 2021

Members must provide the completed Differential Premiums Form for the 2021 premium year. - Month of April 2021

In the month of April 2021, members must notify trustee depositors acting for multiple beneficiaries that the information prescribed by the CDIC Deposit Insurance Joint and Trust Disclosure By-law must be recorded on the member’s records, and must indicate where trustee depositors must send that information. Members may use this template (PDF, 193 KB) of the annual notice. With the aim of raising early awareness of new Professional Trustee requirements that will come into effect April 30, 2022, members are also encouraged to incorporate this awareness message (PDF, 128 KB) into their 2021 annual notice. - By July 15, 2021

Member institutions must provide their completed Return of Insured Deposits (RID) submission and related premium payment for the 2021 premium year by July 15, 2021. (Note: members may either pay the full premium amount for the premium year by July 15, 2021, or pay in two equal installments, the first due by July 15, 2021 and the second due by December 15, 2021.) - By July 15, 2021

Pursuant to subsection 10(c) of the CDIC Deposit Insurance Information By-law, member institutions must provide CDIC with an up-to-date list of all the trade names they use for eligible deposit taking activities, along with their RID submission. For more information about this requirement, please consult the Deposit Insurance Information By-law: Information Bulletin (PDF, 455 KB). - By July 15, 2021

Pursuant to section 11(3) of the CDIC Deposit Insurance Information By-law, member institutions must provide CDIC with an up-to-date list of eligible deposit products that are sold by the member, along with their RID submission. - By December 15, 2021

Members must submit their second premium installment by December 15, 2021, if applicable.

Important Reminders

- Changes to Trade Names

Pursuant to subsection 10(d) of the CDIC Deposit Insurance Information By-law, member institutions must provide CDIC with notice of any new trade name to be used in the course of its deposit-taking activities relating to deposits eligible to be insured by the Corporation, within 15 days of usage. Notice is to be provided by email to members@cdic.ca. - Changes to Directors and Officers

Pursuant to section 18 of the CDIC Deposit Insurance Policy By-law, members must notify CDIC without delay of any material changes to the information provided in accordance with section 15 of the By-law, including any changes to the member’s directors and officers. Notice of any such change must be provided by email to members@cdic.ca. - Notification in respect of Important Transactions

Pursuant to section 17 of the CDIC Deposit Insurance Policy By-law, member institutions must notify CDIC of important transactions, including any proposed change in control, proposed amalgamation or merger, and/or proposed transfers of all or substantially all assets or liabilities. Notice is to be provided by email to members@cdic.ca. - Notice of Material Change (DSIBs)

Pursuant to section 6 of the Canada Deposit Insurance Corporation Resolution Planning By-law, a Domestic Systemically Important Bank (DSIB) must notify CDIC as soon as feasible after the occurrence of a change in a bank group’s legal structure, business, operations, critical functions, critical shared services or material legal entities, or in the laws and regulations applicable to the bank group, that would require one or more amendments to the bank’s resolution plan. Examples of a material change may include an acquisition of an entity that meets the thresholds for a material legal entity, or reorganization of shared services that impacts cross-border execution of the resolution strategy. Notice is to be provided by email to members@cdic.ca.

Speaking Notes by Peter Routledge, President and CEO – Financial Protection Forum – December 1st, 2020.

As Canada’s deposit insurer and as the resolution authority for federally-regulated deposit-taking institutions, CDIC’s ability to deliver on its mandate rests on a sound understanding of key trends and developments in member institutions’ activities and business environment. One critical aspect is the manner with which member institutions fund their lending activities. CDIC closely monitors and analyzes available data and information on our members’ financial profiles and funding activities to gain a deeper understanding of CDIC’s insurance obligations and potential risk exposures.

As of April 2020, CDIC’s members reported total deposits of $4.6 trillion, of which $3.8 trillion is held in Canada with the rest held in foreign subsidiaries owned by our member institutions. Currently $968 Bn in deposits are covered by CDIC.

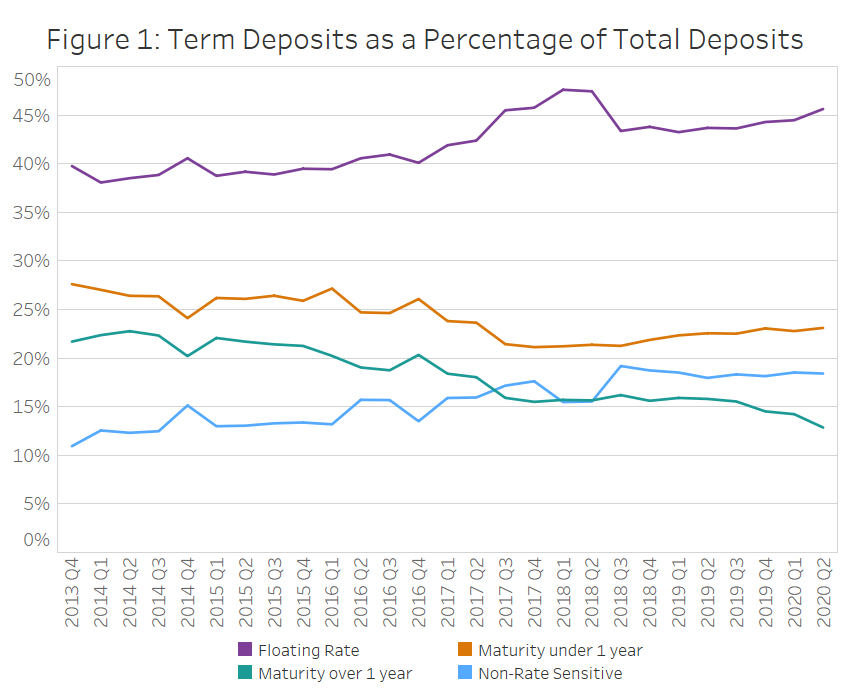

Shift towards shorter term and floating rate deposits

Over the last year, there has been a slight shift from longer term, fixed rate deposits (deposits with maturities greater than 1-year) towards demand of short term, floating rate deposits (e.g., high interest savings accounts). The shift can be attributed to the relatively higher interest rates being offered on floating rate and demand deposits relative to longer-dated and fixed rate deposits.

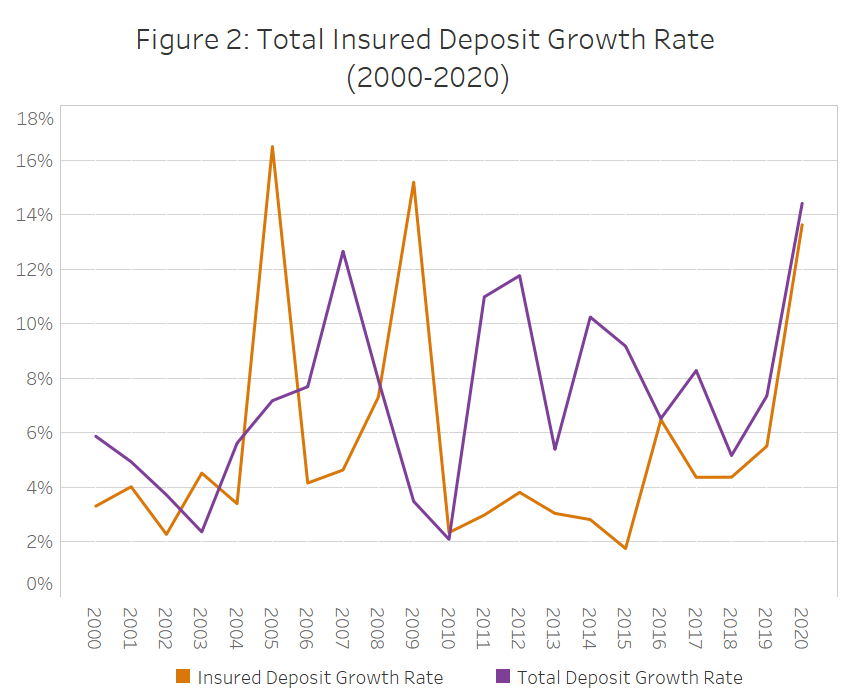

Membership deposits and insured deposit growth accelerated through 2020

Both insured deposits and total deposits grew significantly over the previous year. The growth rate of total deposits doubled from 2019, growing by 14.4% year-over-year, while insured deposits grew 13.6% year-over-year (see Figure 2).

The growth in total deposits reflects several potential factors stemming in particular from the rising uncertainty surrounding the effects of the COVID-19 pandemic, including fiscal stimulus measures and economic conditions.

Meanwhile, amendments to the deposit insurance eligibility criteria and economic impacts of COVID-19 drove the recent growth in insured deposits. In June 2018, the Government of Canada amended the CDIC Act to modernize and enhance Canada’s deposit insurance framework. Several changes impacting deposit insurance coverage came into force on April 30, 2020, which extended coverage to include eligible deposits held in foreign currency and eligible deposits with terms greater than 5 years and eliminated coverage for travelers cheques (travelers cheques are no longer issued by CDIC member institutions).

Foreign currency deposits have grown rapidly and increased 20.1% year-over-year. Over the past 5 years, foreign currency deposits at CDIC member institutions have grown 71.9% or by a compound annual growth rate (“CAGR”) of 11.4%, compared with total deposits, which grew 58% over the last 5 years and had a CAGR of 9.6% (see Table 1). These divergent growth rates are in part attributable to many of Canada’s larger banks expanding deposit gathering activities in foreign jurisdictions, and to foreign exchange movements (which inflate foreign deposit figures when the Canadian dollar depreciates).

Table 1: Long Term Deposit Trends: Canadian and Foreign Currency and Current Value (as at 2020Q2)

| 5Yr Total Growth | 5Yr CAGR | 10Yr Total Growth | 10Yr CAGR | Q2/20 Value ($M) | |

|---|---|---|---|---|---|

| Personal Canadian Currency | 38.8% | 6.8% | 82.1% | 6.2% | 1,178,607 |

| Personal Foreign Currency* | 87.8% | 13.4% | 242.5% | 13.1% | 639,461 |

| Non Personal Canadian Currency | 54.2% | 9.1% | 116.9% | 8.1% | 1,078,043 |

| Non Personal Foreign Currency* | 66.6% | 10.7% | 228.9% | 12.6% | 1,724,139 |

| Total Deposits | 58.0% | 9.6% | 149.0% | 9.6% | 4,620,251 |

| Total Foreign Currency Deposits* | 71.9% | 11.4% | 232.5% | 12.8% | 2,363,601 |

| *Foreign Currency reported in CAD Equivalent | |||||

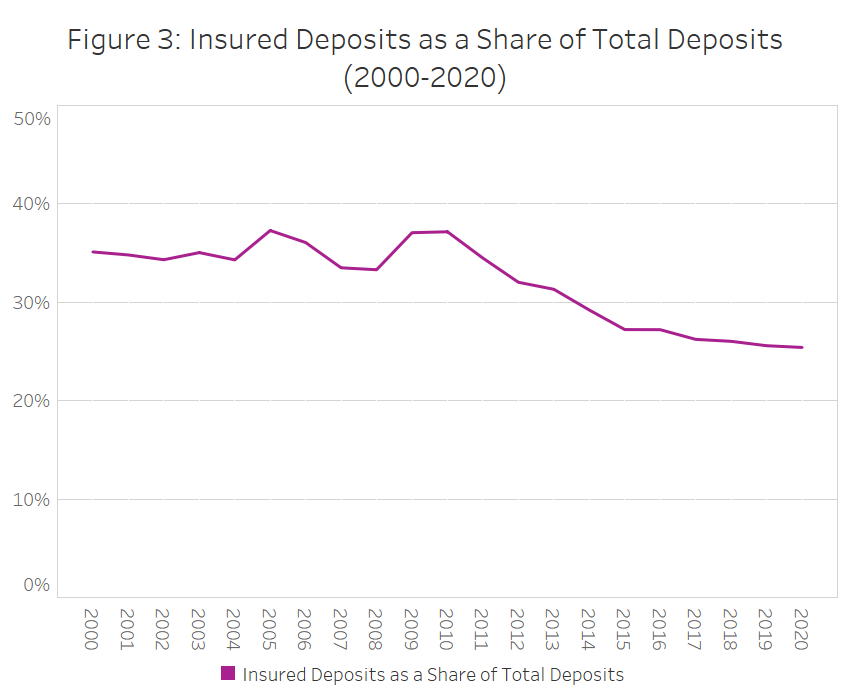

Despite the uptick in insured deposits, insured deposit growth has lagged total deposit growth over the last decade, resulting in a decline in the ratio of CDIC-insured deposits to total deposits. Total deposits grew more relative to insured deposits due to comparatively high growth in deposits over the $100k CDIC insurance limit and growth in foreign deposits in the international operations of certain CDIC members. Eligible insured deposits currently represent about 25% of total deposits, compared to 35% in 2000 (see Figure 3). While declining over the last decade, the share of insured deposits appears to have stabilized. This trend is heavily influenced by Canada’s largest banks, which account for 21.8% of total insured deposits as a percentage of total deposits.

Canadians continue to benefit from a high level of deposit protection

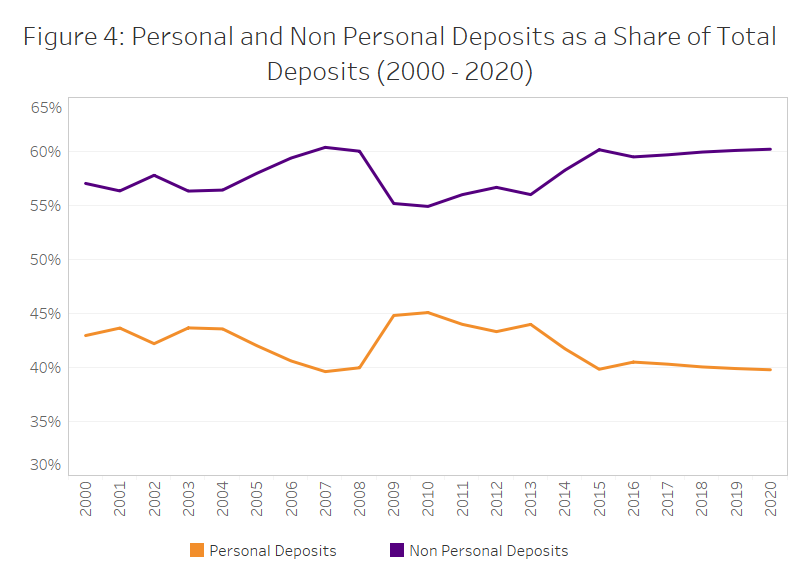

The declining proportion of eligible insured deposits at some institutions has not translated into less deposit protection for Canadian households. Nearly all personal deposit accounts are fully protected by CDIC, meaning that ordinary Canadians continue to benefit from a high level of protection for their deposit savings. For 98% of Canadians, CDIC’s deposit insurance covers all of their deposits. Following a brief rise during the financial crisis of 2008, the share of personal deposits (e.g., interest-bearing demand and notice deposits from individuals) in total deposits has remained relatively stable at approximately 40%.

Uncertainty and change on the horizon

Uncertainty and change remain on the horizon in virtually all aspects of banking as individual Canadians, financial institutions, and regulators respond to the challenges posed by the COVID-19 pandemic.

While several changes related to the Government of Canada’s amendment to the CDIC Act came into force on April 30, 2020, the remaining changes are slated to come into force on April 30, 2022. These changes are designed to modernize and enhance the Canadian deposit insurance framework and extend insurance coverage to support CDIC in the delivery of its mandate, to anticipate and adapt to the changing banking landscape and to meet the needs of depositors.

As Canada adapts to the challenges posed by the COVID-19 pandemic, CDIC remains committed to protecting the deposits of Canadian households and businesses, and to promoting their trust in the Canadian financial system and the confidence that their hard-earned savings placed with our member institutions remain safe and secure.

Speaking Notes by Peter Routledge, President and CEO – Annual Flagship conference – November 17, 2020

OTTAWA – October 27, 2020 – The Canada Deposit Insurance Corporation (CDIC)’s Corporate Plan Summary was tabled yesterday in Parliament.

The five-year plan identifies CDIC’s five major strategic objectives for 2020-2021 to 2024-2025:

- Strategic: transform our Enterprise Risk Management program

- Preparedness: refine our capability to respond quickly and effectively to any member institution failure

- Operational: modernize payout systems and enhance information security practices

- Organizational: implement the Organization and Culture Strategy and Plan

- Reputational: increase public awareness of CDIC deposit protection

CDIC deposit insurance is a critical part of the Canadian financial system’s resiliency and we aim to safeguard and enhance the quality of this protection.

“In today’s uncertain environment, CDIC will adapt our activities to fulfill our number one priority: to meet depositors’ expectations,” said CDIC President and CEO Peter Routledge. “We’ve built flexibility into our plan to enhance CDIC’s preparedness to respond effectively to uncertainty and to protect depositors always.”

The Summary of the Corporate Plan (PDF, 2.45 MB) also includes an overview of CDIC’s operating and capital budgets and borrowing plan from 2020/2021.

CDIC is a federal Crown corporation established in 1967 to protect the savings of Canadians, and we contribute to financial stability by safeguarding close to $970 billion in deposits at more than 80 member institutions. As resolution authority, we are responsible for handling the failure of any of our members, from the smallest to the largest. Our members include banks, federally regulated credit unions, as well as loan and trust companies and associations governed by the Cooperative Credit Associations Act that take deposits. We are funded by premiums paid by member institutions and do not receive public funds to operate. Since our creation, we have resolved 43 member failures affecting some two million Canadians. No one has ever lost a dollar of deposits under CDIC protection.

– 30 –

Further information:

Brad Evenson

Director, Communications and Public Affairs

Tel: 613.943.4395

E-mail: media@cdic.ca

CDIC Chair takes part in international colloquium on recovery and resolution

October 19, 2020

CDIC Chair Bob Sanderson recently took part in a panel discussion as part of the International Insolvency Institute’s Virtual Colloquium on Resolution of Financially Distressed Financial Institutions. Mr. Sanderson discussed CDIC’s powers as Canada’s resolution authority with emphasis on large bank resolution and the importance of cross-border cooperation in the event of failure.

Watch Mr. Sanderson’s presentation.

Watch the entire panel discussion and other sessions from the Virtual Colloquium on Resolution of Financially Distressed Financial Institutions.

Disclaimer: The views and opinions expressed during the panel discussion “Insights from North American Recovery and Resolution systems” are those of the presenters and do not necessarily reflect the official policy or position of the Canada Deposit Insurance Corporation or any other agency.

OTTAWA – October 7, 2020 – The Canada Deposit Insurance Corporation’s (CDIC) 2020 Annual Report was tabled yesterday in Parliament.

“As Canadians continue to respond courageously to the many challenges presented by the pandemic, we can take one concern off our list. We don’t have to worry about the safety of deposits protected by CDIC,” said President and CEO Peter Routledge. “Since its establishment in 1967, no one has lost a single dollar of deposits under CDIC protection.”

“We at CDIC stand ready to fulfill our mandate by protecting the deposits of Canadians, by promoting financial stability and by serving as the resolution authority for all of our members.”

CDIC’s 2020 Annual Report highlights progress made against strategic priorities, including:

- Modernizing our insurance and payout processes, which will ultimately enhance our service to Canadians using modern, fast and secure technologies that will adapt to an evolving banking landscape.

- Strengthening our resolution planning processes.

- Launching CDIC’s three-year Organization and Culture Strategy and Plan to transform the organization’s culture, enhance organizational effectiveness and sharpen the Corporation’s focus on its most pressing risks.

- Increasing public awareness of CDIC or federal deposit protection to 61% of Canadians as of March 2020. Awareness has grown steadily over the past three years, particularly in our target demographics such as Canadians aged 18–34 and Canadians of more moderate means.

These initiatives have strengthened our preparedness and leave CDIC very well positioned to manage through the uncertainty that attends Canada’s COVID-19 recovery.

The CDIC 2020 Annual Report also outlines CDIC’s financial performance over the past year.

CDIC is a federal Crown corporation established in 1967 to protect the savings of Canadians, and we contribute to financial stability by safeguarding close to $970 billion in deposits at more than 80 member institutions. As resolution authority, we are responsible for handling the failure of any of our members, from the smallest to the largest. Our members include banks, federally regulated credit unions as well as loan and trust companies and associations governed by the Cooperative Credit Associations Act that take deposits. We are funded by premiums paid by member institutions and do not receive public funds to operate. We have resolved 43 member failures affecting some two million Canadians. No one has lost a dollar of deposits under CDIC protection.

– 30 –

For further information:

Brad Evenson

Director, Communications and Public Affairs

Tel: 613.943.4395

E-mail: media@cdic.ca

OTTAWA – August 11, 2020 – Earlier today, Canada Deposit Insurance Corporation (CDIC) held its Annual Public Meeting via live webcast. CDIC President and CEO Peter Routledge, discussed how deposit insurance protects Canadians’ hard-earned savings and how recent changes to the deposit insurance regime have improved protection for Canadian depositors. Mr. Routledge was joined by Robert Sanderson, Chair of the Board of Directors, and Chantal Richer, Chief Operating Officer, who spoke about CDIC’s public awareness efforts and how CDIC is reaching out to Canadians to inform them about how CDIC protects their savings.

“The updated coverage was announced in the 2019 budget following an extensive consultation and policy review process.” said Mr. Routledge. “The expanded coverage provides Canadians with more flexibility in how they save their money.”

The meeting concluded with Mr. Routledge, Ms. Richer and Mr. Sanderson responding to questions submitted by the public.

– 30 –

Further information

Brad Evenson

Director, Communications and Public Affairs

Tel: 613.943.4395

E-mail: media@cdic.ca

CDIC’s 2020 Annual Public Meeting – August 11, 2020

Peter Routledge, President and CEO of CDIC, was joined by Robert Sanderson, Chair of the Board of Directors and Chantal Richer, Chief Operating Officer. They spoke about how deposit insurance protects Canadians’ savings, the recent improvements to deposit protection, and how CDIC is reaching out to Canadians to promote financial stability. Brad Evenson acted as moderator.

CDIC knows that it’s important for the financial community to remain informed about deposit protection. That’s why we’ve developed training and learning initiatives to help financial professionals understand our rules and how deposit insurance works.

In light of recent changes to deposit insurance, CDIC has updated and relaunched CDIC Financial Professional Trivia Challenge, our training game for financial professionals.

The online training game is a fun and engaging way for financial professionals to better understand deposit insurance and the role that CDIC plays in protecting depositors in the event of a member failure. Players can learn about a variety of topics, including the deposit insurance limit, registered plans, and information on CDIC’s coverage rules with respect to trust accounts and brokered deposits, all while playing rounds and earning points.

Members of the financial community can complete this one-hour course for free and earn a continuing education (CE) credit from the accreditation body of which they are a member, including the Institute for Advanced Financial Education, Investment Industry Regulatory Organization of Canada (IIROC), CSF (Chambre de la Securité financière), and L’Institut québécois de planification financière (IQPF).

As financial professionals are a trusted source for Canadian depositors, CDIC wants to ensure that they are equipped with accurate information when they advise their clients on the protection available to them. Upon completion of the training game, a certificate will be issued for their records.